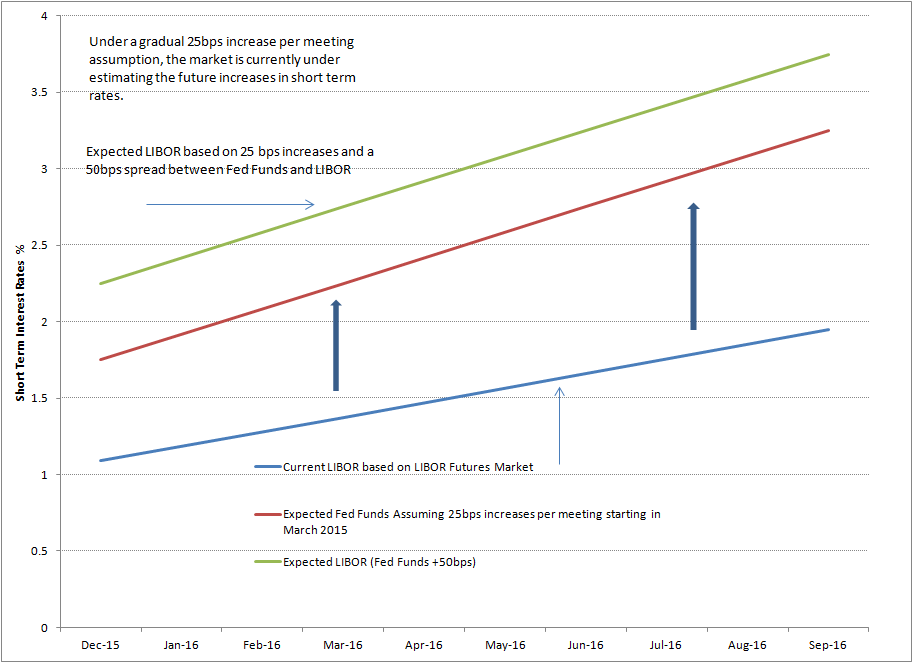

LIBOR Continues to Misprice Fed Rate Hike Expectations

We put together a quick graph of short term interest rates and the market’s expectations of future rates. The current LIBOR curve as measured by the LIBOR Futures market predicts rates to rise to between 1.09% and 1.95% from December 2015 to September 2016 (Charted as the blue shaded line below). We then assumed that the Federal Reserve would begin to raise the Fed Funds rate in March 2015 and do so in 25bps increments at each subsequent FOMC meeting (The expected Fed Funds using that scenario is plotted in Red). Historically, LIBOR trades at a spread to Fed Funds (approximately 50bps). We then derived an expected LIBOR curve based upon the expected Fed Funds rate (Charted as the green line). This shows that the LIBOR Futures market is currently under-estimating the rate rise even under a very gradual FOMC path.

Source: Eurodollar (LIBOR) Futures Curve – 9/19/14